iStrata Intelligence is super excited to release our first intelligence report focusing on APAC – Beauty and Cosmetic Industry. The purpose behind the report is to bring more awareness of the beauty and cosmetics landscape in Asia pacific region and especially countries like Indonesia, Malaysia and Singapore. The report may not cover about everything but the breadth of different brands and markets. We plan to improve the report once in a quarter with updated intelligence about the market landscape.

Consumer behavior

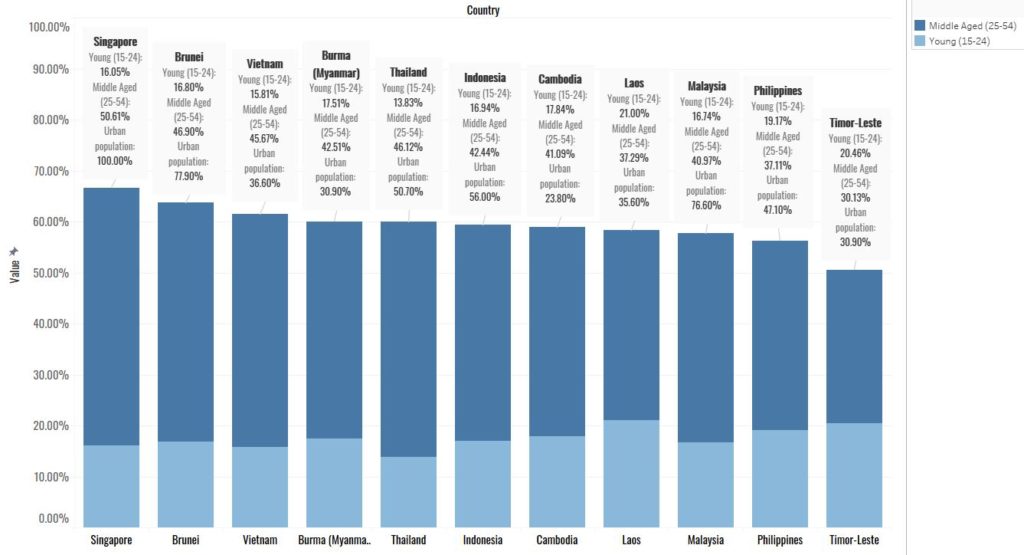

Our target audience is the people who are of age 15-54. Which comprises 60% population in SouthEast Asia. Usually living an urban life. These countries nowadays are increasingly image and fashion-conscious. Daily make-up has become a basic

need among working women. While women continue to be the dominant consumers of cosmetic products, sales to the male market segment are steadily increasing. The younger generation has also become regular users of cosmetics and skincare products. Consumer spending increases during holiday seasons.

Based on Age

Young population (15-24)

Almost 1/6th of the population in Southeast Asia are youths that are the biggest consumer of cosmetic and beauty products. Young consumers are more inclined to shop around, use different products, and select from different brands. They are always ready to explore new brands and more price-sensitive.

Females

- They tend to care a lot about their beauty and makeup products and visit parlors or spa almost 3 times more frequently than men.

- Due to the trend of K-pop and K-drama, there has been a boost in Korean products amongst female youths.

- They buy almost three to four and at most five skincare products that are: cleanser, toner, moisturizer, sunscreen, and acne treatment.

- For hair care, they use two to three products: shampoo, conditioner, and hair serum.

- Main purchase influencers are friends, social media, and YouTube beauty bloggers and vloggers.

Males

- Males in this age group usually are simpler and tend to use mass-market brands in terms of skin-care products like cleanser and acne treatment.

- Men of this age are more focused on hair grooming and use two to three products like shampoo, conditioner, and hair styling products.

- Popular culture also has a huge influence. J-pop and K-pop artists universally put fashion and beauty at center stage in their work.

Middle Aged (25-54)

Household income level is also a major deciding factor in the consumption habits of this group. Middle-aged consumers exhibit strong preferences and they tend to become loyal to one brand. They constitute the majority of the population of more than 40%. With the highest in Singapore, Brunei, and Thailand

Females

- The trend towards natural cosmeceuticals and organic products has seen a huge incline.

- The number of skin-care products used for this age group can be upwards of eight products for females.

- Daily rituals include double cleanse, tone, essence and/ or serum, eye cream and face cream, sunscreen, and the weekly scrub and mask.

- The main influencers are facial and spa treatment centers, retail outlets, direct selling companies, and friends.

Males

- Men are more inclined towards basic grooming, and a big proportion can be classified in the metrosexual category.

- They are usually the urban population largely attributable to manufacturers advertising campaigns “that successfully boosted men’s interest in self-grooming”.

- They use basic face cleansers and hair care products.

High-end Consumer

- High-end consumers are concentrated primarily in urban areas.

- Singapore, Brunei, and Malaysia are one of the highest consumers of higher-end products due to the very high percentage of Urban Population.

- The quality, trends, and brand names play an important role in their personal choices.

- Reputation and name recognition continue to drive their cosmetic purchases.

- High-end consumers are willing to pay a higher price for well-known branded products, which convey higher social status.

- They recognize that looking good is as much about feeling good and this translates to boosted confidence.

Middle or low Consumer

- The middle and lower level income groups are very price-conscious and susceptible to economic swings.

- Vietnam, Laos, Burma, Timor Leste, and Cambodia have the highest populations due to less urbanization.

- They usually go for the mass market products and keep these as a secondary expense.

- Consumer spending increases during holiday seasons, such as Eid al-Fitr or Idul Fitri, Chinese New Year, and Christmas.

- Beauty forums, blogs, Facebook, and Weibo have become the latest platforms for promotions of cosmetics as they are one of the major influencers to consumers’ purchasing decisions.

Product Trends

Typically, mass-market/ value pricing products do better compare to premium products due to pricing. While some big local manufacturers produce and own their house brands, a growing number of local players turn to local cosmetic manufacturers and focus on the contract or private labeling.

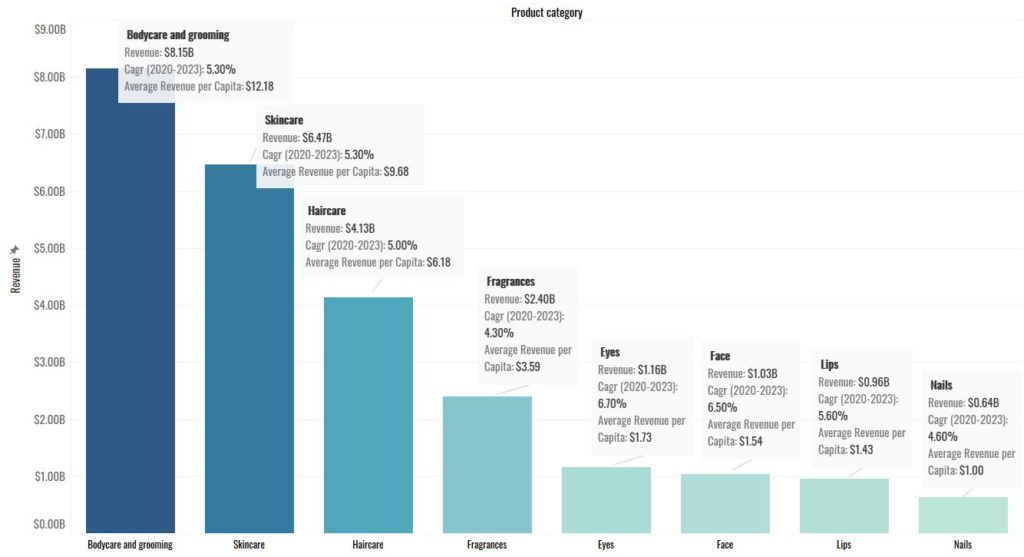

The beauty and cosmetic market are divided into 3 major segments that are makeup, personal care, and fragrances. Where makeup can be of face, lips, nails, and eyes. And personal care consists of skincare, haircare, and body care. The highest revenue is from the personal care segment that is more than US$18.75billion. Whereas the makeup and cosmetics annual revenue account to US3.784billion and fragrance market at 2.397billion in Southeast Asia. With an emerging natural cosmetic market of US$515.9m. Southeast Asia has also seen the highest market share of 61.6% of Halal cosmetics globally.

Local Cosmetic market trends

As a larger number of local brands are launching similar color cosmetics products as premium brands consumers are now trading down to cheaper local brands. FashionValet is among the established online fashion retail platforms that curate brands by local entrepreneurs.

They are mainly founded by fashion entrepreneurs, professional make-up artists, and celebrities as well as social media influencers. Due to high awareness in social media of local brands, there are more young buyers. Usually, people tend to use local brands in order to support their social media influencers. The local cosmetic market has shown a boom in halal and cruelty-free products.

Singapore

To stay and lead the competition of the market, brands are heavily investing in advertising, promotions, marketing, market research & development. Most of the firms are manufacturing its products in low-cost countries because Singapore’s manufacturing cost is too high.

Malaysia

Malaysia tends to use a competitive strategy to promote a high discount for the brand cosmetics and installment sale for the costlier products. The huge numbers of brand cosmetics face high competition with the new products as well as other foreign products which are widely available.

Indonesia

There is a trend by producers to make their products appear and feel more premiums for consumers who want to indulge in such experience. Indonesian consumers state that they seek beauty and grooming products that match their religious beliefs. Which has shown a huge demand is halal products as well as natural products.

Halal Products

- The Halal cosmetics market is currently estimated to be 61.6% market share in Southeast Asia.

- Target customers are the Muslim population that is about 242 million in Southeast Asia that are the potential market. With the majority in Brunei, Malaysia, and Indonesia.

- Indonesia announced that they would be bringing in mandatory Halal certification for cosmetics whereas Malaysia does not yet have compulsory Halal certifications.

- Particular opportunities lie in hair care products for women wearing hijabs, as well as in body care with anti-perspiration and deodorization functions for humid conditions.

- Halal industries including the cosmetics industry position Malaysia as the global Halal-Hub.

- Halal brands can use emotional messages based around ethical lifestyles or health and wellness to resonate with a broader consumer base in Asia, and not just Muslims.

- Skincare (31%) is the largest halal sector within Southeast Asia but haircare (13%) and body care show white space opportunities for product innovation.

- Halal and wuduk (ablution)-friendly elements are significant marketing factors in some local cosmetics brands such as SimplySiti, Ronasutra, Zawara, Nurayysa Beauty, and Sugarbelle Cosmetics.

Korean Products

- The rise in Korean cosmetic product sales can be attributed to the increasing popularity of Korean pop culture

- Korean consumer buying habits are changing; focusing on purpose and functionality rather than brand awareness.

- The Korean beauty wave continued to be a major driver of the growth for colour cosmetics as it gained mass acceptance

- Korean cosmetics market is revamping its products to suit Muslims and darker-skinned women in Southeast Asia

- K-Beauty trends and celebrity looks have a great influence on consumer trends for fashion, beauty, and lifestyle.

- Amore Pacific and LG Household & Health Care Ltd. are the two clear leaders in the Korean cosmetic market.

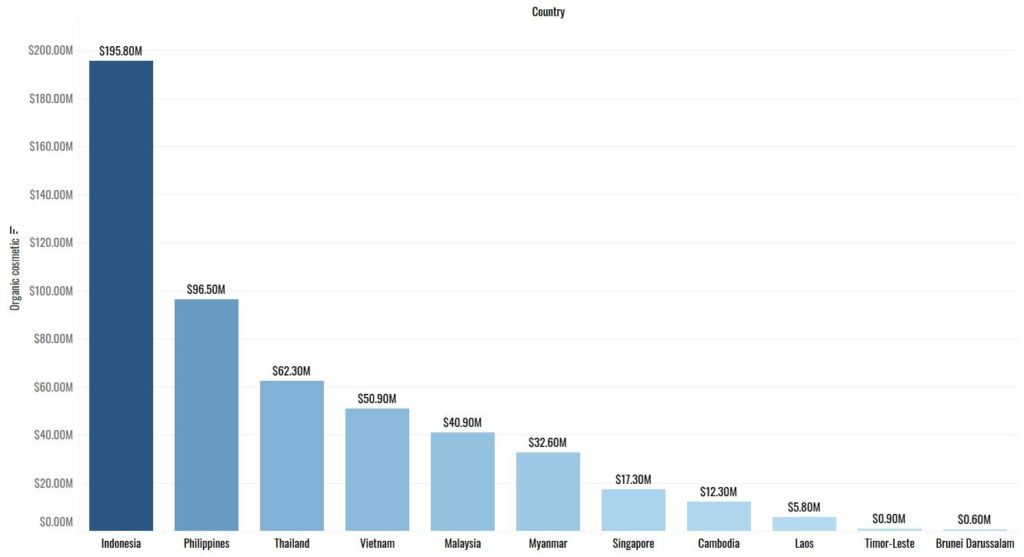

Organic Products

- Products that contain medicinal, natural, or nutritional ingredients such as vitamins, aloe, and traditional medicines are very popular.

- Veganism has become a buzzword in the local cosmetics industry as the increased focus on animal rights has impacted the market.

- There is an increasing preference for herbal and organic products, as consumers become more health-conscious and opt for safer, chemical-free treatments.

- Bad press and increased public awareness about the possible toxicity and adverse health effects of beauty products containing artificial chemicals have helped this trend gain traction.

Indie Beauty

- A lifestyle and community of independently owned businesses. It does not receive any corporately-backed funding to keep it going and its startup funds come from the shop owner him or herself. These owners typically have a deep passion for quality and sustainability. To increase traffic and customers, Indie beauty brands generally support local businesses or collaborate with other Indie companies as well as use social media to tell compelling stories to market their business.

Pricing

Mass Market Pricing

Premium Market Pricing

Market Landscape

- We consider Korea & Japan as the main market leaders who own the brand

- Emerging local markets: Indonesia, Malaysia, Singapore

- In the market landscape section, Find details about shopping habits on

- Categories they buy

- The price point of different brands and their products

- Channels people used to make purchases: More about online and less details about offline/department stores

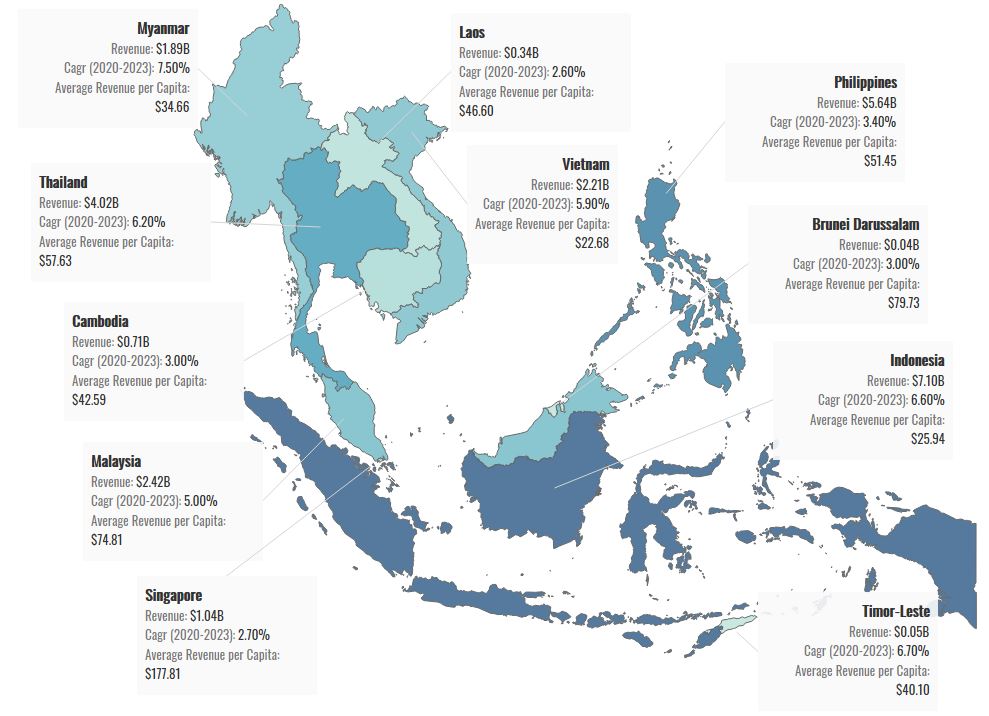

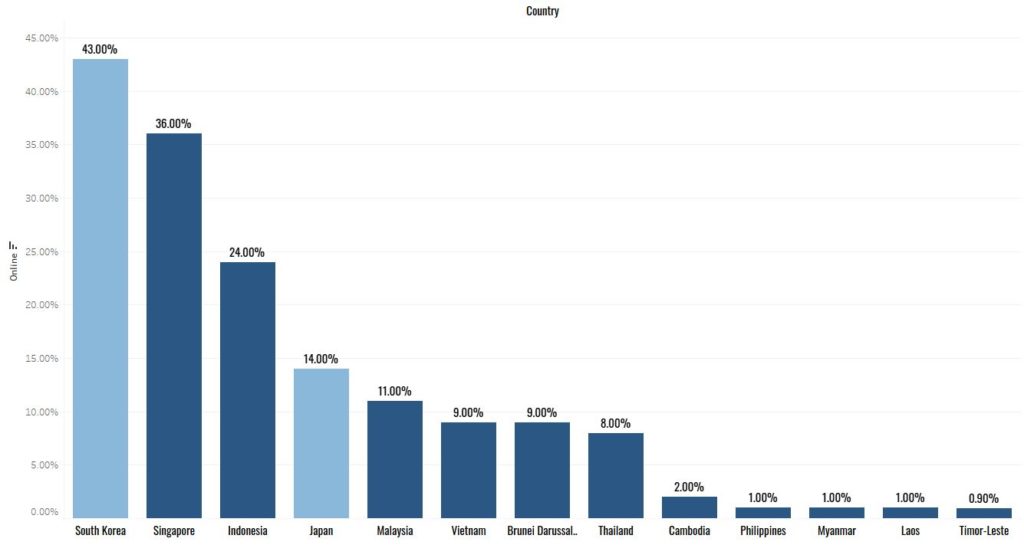

In Southeast Asia revenue in the Cosmetics segment amounts to US$25.449billion in 2020. The market is expected to grow annually by 5.3% (CAGR 2020-2023). The average revenue per person in the segment amounts to US$38.6. Where 74% of sales contribute to mass-marketed cosmetics and 26% on luxury items. In which only 13% attributes to online sales.

Indonesia led with revenue of US$1,616.4m with almost 38% of the total. Whereas the highest spending with average revenue per capita is Singapore with 30.14$ which is more than double of any other country. The biggest emerging market is Myanmar with the highest growth of CAGR 7.7%.

Indonesia

Revenue in the Beauty and Cosmetics segment amounts to US$7.095b in 2020. The market is expected to grow annually by 6.6% (CAGR 2020-2023).In relation to total population figures, per person revenues of US$25.94 are generated in 2020.

Where 78% of sales are attributable to Non-Luxury goods that are mass-marketed products and 22% to luxury goods. There is a very low urban population despite steady growth that in 2020 has gone to 56%.

Due to a huge boom in the e-commerce sector and adoption of the beauty and cosmetic industry currently, 11% of the total sales come from the online medium whereas 89% comes from the direct and retail market.

Indonesia is also named as Asia’s quickest-growing beauty market for beauty in terms of compound annual growth rate. Total domestic sales of beauty products in the country is IDR 11 trillion or USD 818 million in 2015 based on data from the Ministry of Industry.

Despite various promotional and marketing efforts by domestic brands in years, global brands, be it locally manufactured or imported, still dominate cosmetic sales in Indonesia.

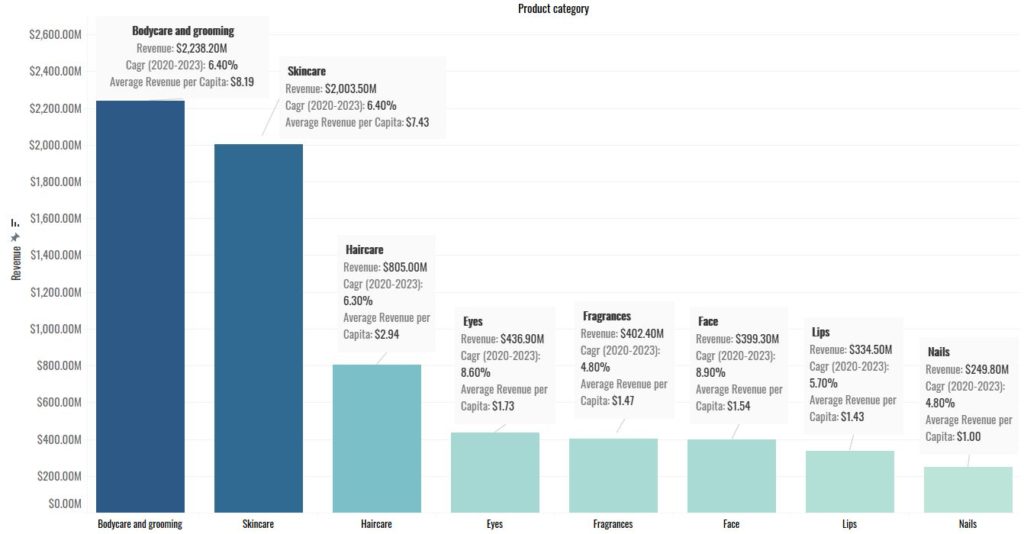

Based on the product category

- Face

Revenue in the Face segment amounts to US$399.3m in 2020. The market is expected to grow annually by 8.9% (CAGR 2020-2023). The average revenue per person in the segment for Face amounts to US$1.46 in 2020.

2. Lips

Revenue in the Lips segment amounts to US$334.5m in 2020. The market is expected to grow annually by 5.7% (CAGR 2020-2023). The average revenue per person in the segment for Lips amounts to US$1.22 in 2020.

3. Eyes

Revenue in the Eyes segment amounts to US$436.9m in 2020. The market is expected to grow annually by 8.6% (CAGR 2020-2023). The average revenue per person in the segment for Eyes amounts to US$1.60 in 2020.

4. Nails

Revenue in the Nails segment amounts to US$249.8m in 2020. The market is expected to grow annually by 4.8% (CAGR 2020-2023). The average revenue per person in the segment for Nails amounts to US$0.9 in 2020.

5. Skincare

Revenue in the Skincare segment amounts to US$2.003b in 2020. The market is expected to grow annually by 6.4% (CAGR 2020-2023). The average revenue per person amounts to US$7.43 in 2020.

6. Haircare

Revenue in the Haircare segment amounts to US$805m in 2020. The market is expected to grow annually by 6.3% (CAGR 2020-2023). The average revenue per person amounts to US$2.94 in 2020.

7. Bodycare and Grooming

Revenue in the Bodycare and grooming segment amounts to US$2.238b in 2020. The market is expected to grow annually by 6.4% (CAGR 2020-2023). The average revenue per person amounts to US$8.19 in 2020.

8. Fragrances

Revenue in the Fragrance segment amounts to US$402.4m in 2020. The market is expected to grow annually by 4.8% (CAGR 2020-2023). The average revenue per person amounts to US$1.47 in 2020.

Local cosmetic market leaders

| Rosé All Day– It has a range of long-wearing lip and cheek duo sticks.- With a “no makeup” makeup look mantra with affordable price | |

| Rollover Reaction – The liquid lipsticks are bold, highly-pigmented, and matte.- Inspired by style icons of the pre-Kylie era- Very high-quality products for a premium experience | |

| LAYN Cosmetics– LAYN has you covered with their multi-purpose lipsticks.- Known for having affordable prices. | |

| Wardah Beauty– It is known for oily or acne-prone skin type consumers.- It has C-infused serums to oil-free face powders- The brand is also certified Halal | |

| BLP Beauty– It has a selection of liquid lipsticks, eyeshadows, and brow products at an affordable price point – Started by Indonesian YouTube beauty guru Lizzie Parra | |

| ESQA Cosmetics– They are a vegan makeup brand – known for classy but casual matra |

| Brand | USP | Category they target | Price point | Vegan & Organic |

| Wardah Cosmetics | Makeup, Skincare, Hair | Above RM 100 | Yes | |

| Rollover Reaction | Free shipping on orders over IDR 1k | Makeup | Above IDR 500k | No |

| BLP Beauty | Free shipping w/o min purchase | Makeup | Under IDR 200k | No |

| Rose All Day Cosmetics | Free shipping min IDR 150k | Makeup | Under IDR 400k | No |

| Dear Me Beauty | Makeup | ABove IDR 400k | No | |

| Makeover | Makeup | Under IDR 150k | Yes | |

| LAYN | Makeup | IDR 150k | No | |

| ESQA | ESQA loyalty points | Makeup | Under IDR 300k | Yes |

| Polkabeauty | Makeup | Under IDR 500k | No | |

| Viva Cosmetics | Free shipping for any purchase min IDR 100k | Makeup | Under IDR 300k | No |

Singapore

Singapore’s beauty and personal care revenue has reached US$1.04 billion in 2020 and the market is expected to grow annually by 2.8%. With the highest average revenue per capita of around $177.81

Especially revenue in the cosmetics segment amounts to US$177.9m in 2020. The market is expected to grow annually by 2.8% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$30.41 are generated in 2020.

Where 71% of sales are attributable to Non-Luxury goods that are mass-marketed products and 29% to luxury goods. They have the highest number of urban population that in 2020 is 100%.

Due to a huge boom in the e-commerce sector and adoption of the beauty and cosmetic industry currently, 15% of the total sales come from the online medium whereas 85% comes from the direct and retail market.

The market is characterized by premiumization, with cosmetics boasting high-value ingredients and polished packaging and marketing, particularly in color cosmetics, skincare, and fragrance. To stay and lead the competition of the market, brands are heavily investing in advertising, promotions, marketing, market research & development. Most of the firms are manufacturing its products in low-cost countries because Singapore’s manufacturing cost is too high.

Singapore is one of the preferred destinations for global cosmetic players in the Southeast Asian region. Rising concern and awareness about the beauty and personal care issues are among the main driving forces behind Singapore’s cosmetic growth spurt. Further, rising per capita disposable income for women is also accelerating the cosmetic sales in Singapore.

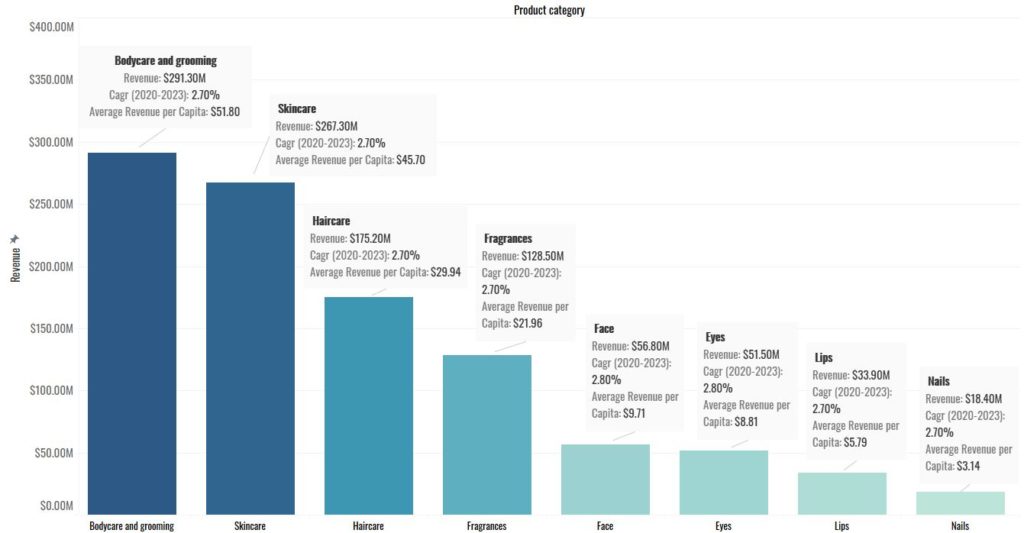

Based on the product category

- Face

Revenue in the Face segment amounts to US$56.8m in 2020. The market is expected to grow annually by 2.8% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$9.71 are generated in 2020.

2. Lips

Revenue in the Lips segment amounts to US$33.9m in 2020. The market is expected to grow annually by 2.7% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$5.79 are generated in 2020.

3. Eyes

Revenue in the Eyes segment amounts to US$51.5m in 2020. The market is expected to grow annually by 2.8% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$8.81 are generated in 2020.

4. Nails

Revenue in the Nails segment amounts to US$18.4m in 2020. The market is expected to grow annually by 2.7% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$3.14 are generated in 2020.

5. Skincare

Revenue in the Skincare segment amounts to US$267.3m in 2020. The market is expected to grow annually by 2.7% (CAGR 2020-2023). The average revenue per person amounts to US$45.7 in 2020.

6. Haircare

Revenue in the Haircare segment amounts to US$175.2m in 2020. The market is expected to grow annually by 2.7% (CAGR 2020-2023). The average revenue per person amounts to US$29.94 in 2020.

7. Bodycare and Grooming

Revenue in the Bodycare and grooming segment amounts to US$291.3m in 2020. The market is expected to grow annually by 2.7% (CAGR 2020-2023). The average revenue per person amounts to US$51.8 in 2020.

8. Fragrances

Revenue in the Fragrance segment amounts to US$128.5m in 2020. The market is expected to grow annually by 2.7% (CAGR 2020-2023). The average revenue per person amounts to US$21.96 in 2020.

Local cosmetic market leaders

| SNH Cosmetics They are famous for carrying ultra-lightweight matte liquid lipsticks. And others like glow mists, velvet lipsticks and brush solid shampoos. | |

| Suiinaturals They offer chemical-free makeup products using only natural ingredients.They are bone of the most famous organic brands | |

| INGA Specializes in quality lipstick products made suitable for tropical weather They offer cruelty-free with reasonably priced products | |

| 13rushes They have a range of synthetic brushes that are both cruelty-free and affordably priced. Specially crafted using a quick-drying and mold-resistant fiber. | |

| Indulg3 Indulg3 Cosmetics believes that quality matte liquid lipstick doesn’t have to be costly. They are cruelty-free and formulated to last up to 8 hours. | |

| Candela Started by beauty blogger Erin alongside her three high school friends. They offer a range of cruelty-free and environmentally-friendly cosmetic products | |

| Zahara They started as halal and Muslim-friendly makeup brand. They have specially formulated nail products that permeate water and oxygen through the polish. | |

| SHOPHOUSE SIXTYFIVE They are all cruelty-free and handcrafted using only quality natural ingredients. All of the products are uniquely named after local food and places. | |

| Faux Faycrange of quality cosmetics such as lipsticks, concealers, and eyeliners. Known as a special occasion product for that million-dollar look. |

| Brand | USP | Category they target | Price point | Vegan & Organic |

| Solo Cosmetics | Free hand sanitizer with every purchase | Makeup | Under $15 | Yes |

| Frank Body | Truly Organic, Always | Skincare | Under $100 | Yes |

| Liht Organics | Organic makeup that’s safe enough to eat | Makeup | Under $100 | Yes |

| Katfood | Skincare | Under $50 | Yes | |

| Rooki Beauty | Free local shipping, no min spend | Skincare | Above $50 | Yes |

| Sen Natural | Fast worldwide delivery | Makeup, Skincare | Under $50 | Yes |

| Pera Skincare | Enjoy up to 50% discount + free shipping to SG & HK | Skincare | Above $100 | Yes |

| Sigi Skin | Free international delivery over $200 | Skincare | Under $150 | No |

| Allies of Skin | Free shipping on all orders above $75 | Skincare | Under $130 | Yes |

| Alcheme | Skincare | Under $140 | Yes |

Malaysia

Beauty and personal care revenue have reached US$2.421 billion in 2020 and the market is expected to grow annually by 5%. With the average revenue per capita of around $74.81

Especially Revenue in the Cosmetics segment amounts to US$366.2m in 2020. The market is expected to grow annually by 5.0% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$11.32 are generated in 2020.

A steady economic growth driven by strong domestic demand and private consumption is boosting Malaysia’s Cosmetics & Toiletries industry, which is expected to grow at a compound annual growth rate (CAGR) of 4.2% from RM6.4bn (US$1.6bn) in 2018 to RM7.9bn (US$2.1bn) by 2023. Skincare products held the largest value share of 29.3%, followed by hair care products with 16.9% in 2018. The make-up category is set to grow at the fastest value CAGR of 4.71%, followed by feminine hygiene products with a value CAGR of 4.65% during 2018–2023.

Where 74% of sales are attributable to Non-Luxury goods that are mass-marketed products and 26% to luxury goods. There has been a steady growth in the urban population that in 2020 has gone to 76%.

Due to a huge boom in the e-commerce sector and adoption of the beauty and cosmetic industry currently, 11% of the total sales come from the online medium whereas 89% comes from the direct and retail market.

The beauty and health market in Malaysia is growing fast. Consumer expenditure rates on cosmetics and toiletries increased during the last few years. Malaysian consumers tend to obtain beauty products from top name brands that are marketing specifically in terms of enhancing their youthful appearance. with an increase in sales of halal products and known as the halal hub.

Based on the product category

- Face

Revenue in the Face segment amounts to US$103.8m in 2020. The market is expected to grow annually by 5.4% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$3.21 are generated in 2020.

2. Lips

Revenue in the Lips segment amounts to US$75.0m in 2020. The market is expected to grow annually by 4.8% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$2.32 are generated in 2020.

3. Eyes

Revenue in the Eyes segment amounts to US$100.3m in 2020. The market is expected to grow annually by 5.2% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$3.10 are generated in 2020.

4. Nails

Revenue in the Nails segment amounts to US$46.2m in 2020. The market is expected to grow annually by 4.4% (CAGR 2020-2023). In relation to total population figures, per person revenues of US$1.43 are generated in 2020.

5. Skincare

Revenue in the Skincare segment amounts to US$633.4m in 2020. The market is expected to grow annually by 4.5% (CAGR 2020-2023). The average revenue per person amounts to US$19.57 in 2020.

6. Haircare

Revenue in the Haircare segment amounts to US$426.1m in 2020. The market is expected to grow annually by 4.5% (CAGR 2020-2023). The average revenue per person amounts to US$13.7 in 2020.

7. Bodycare and Grooming

Revenue in the Bodycare and grooming segment amounts to US$680.3m in 2020. The market is expected to grow annually by 4.5% (CAGR 2020-2023). The average revenue per person amounts to US$21.63 in 2020.

8. Fragrances

Revenue in the Fragrance segment amounts to US315.4m in 2020. The market is expected to grow annually by 4.40% (CAGR 2020-2023). The average revenue per person amounts to US$9.75 in 2020.

Local cosmetic market leaders

| NITA CosmeticsA wide range of affordable & hypoallergenic makeup products with a wallet-friendly price | |

| Fame Cosmetics They have their signature matte lipstick and other moist cushions, eyeliners and pocket mirror started by 3 cosmetic bloggers | |

| Chique Cosmetics Their products are mainly inspired by Pop Art and bright colors. With high-quality and reasonably priced makeup products | |

| SIMPLYSITI It has a variety of fragrances and skincare products. High-quality cosmetics range started by Singer | |

| Velvet Vanity Cosmetics The range of products are both cruelty-free and 100% vegan, making them safe and suitable to use for every skin type. | |

| SO.LEK Cosmetics The products are made from high-quality ingredients and yet affordably priced. | |

| Breena Beauty founded by famous beauty blogger Sabrina Tajudin offering products that are of high quality but without the prices that break your bank. | |

| Madu CosmeticsFounded by Hunny Madu, local singer and media personality. With range of cruelty-free and no harmful preservatives makeup products | |

| SILKYGIRL Offers a wide range of cosmetics products like lipsticks, eyeliners, and makeup removers. Also have SG Men fragrances for men. | |

| Sugarbelle Cosmetic Their product lines are paraben-free, halal-certified, and also wudhu-friendly, making them suitable for use for modern Muslimah. |

| Brand | Category they target | Price point | Vegan & Organic | |

| Nita Cosmetics | Makeup | Under RM 60 | No | |

| SO.LEK Cosmetics | Makeup | Under RM 190 | Yes | |

| Sugarbelle Cosmetic | Makeup | Under RM 100 | Yes | |

| Velvet Vanity | Makeup | Under $50 | Yes | |

| dUCk Cosmetics | Makeup | Under RM 120 | Yes | |

| Prettysuci | Makeup, Skincare | Above RM 100 | Yes | |

| DIDA | Makeup | Under RM 120 | Yes | |

| Orkid | Makeup | Under RM 150 | Yes | |

| Breena Beauty | Makeup | Above RM 30 | Yes |

Brands from South Korea

South Korea is one of the ten biggest beauty markets around the world. Across skin care products, color cosmetics, and hair care products, its beauty and personal care industry has shown constant growth for almost a decade.

| Brand | USP | Category they target | Price point | Vegan & Organic |

| Aromatica | Everyone loves free samples | Skincare, Hair | Under $100 | Yes |

| Whamisa | By Organic Fermented, It brings the beauty of nature. | Skincare | Under $50 | Yes |

| Innisfree | Shop more, earn more | Makeup, Skincare | Under $50 | Yes (some) |

| MISSHA | Get 10% off when you join our text alerts | Makeup, Skincare | Under $200 | No |

| Cosrx | World Wide FREE SHIPPING WITH $50 over PURCHASE! | Skincare | Under $50 | Yes (some) |

| Neogen | FREE SHIPPING ON ALL U.S. ORDERS $50+ | Skincare | Under $100 | Yes (some) |

| Skinfood | Free shipping over $50 | Skincare | Under $50 | Yes |

| Mamonde | Choose any 3 samples with your Mamonde purchase | Skincare | Under $50 | Yes (some) |

| Etude House | Free shipping on orders over $100 | Makeup, Skincare | Under $50 | No |

| Nature Republic | Free shipping on orders over $75 | Skincare, Makeup, Hair | Under $50 | Yes |

Brands from Japan

In addition to its massive consumption of beauty, in recent years Asia has also been a source of innovation for the beauty industry with the West particularly fascinated with K-Beauty (from Korea) and more recently J-Beauty (from Japan).

| Brand | USP | Category they target | Price point | Vegan & Organic |

| Shiro | Makeup, Skincare | Over 6k Yen | Yes | |

| Ruhaku | Skincare | Under $50 | Yes | |

| Aqua Organic | The spirit of nature | Makeup, Skincare | Over 6k Yen | Yes |

| THREE | Makeup, Skincare | Over 10k Yen | Yes | |

| Hana Organic | Makeup, Skincare | Under 5k Yen | Yes | |

| Naturaglace | Makeup | Under 5k Yen | Yes | |

| DHC | Free shipping | Skincare | Over $50 | No |

| Do Organic | Skincare | Under 10k Yen | Yes | |

| Organic & Co | Skincare | Under $100 | Yes | |

| Sekkisei | Free shipping $60+ | Skincare | Under $100 | No |

Brands from Philippines

Beauty products owners revealed how they foresee the future of the beauty industry in the Philippines especially in the digital age.

With the constant release of online reviews, Filipinos easily identify which beauty products will give the promised results

The value share of the Philippines in the Asia-Pacific (APAC) region is expected to decrease from 2.1% in 2018 to 1.8% in 2023, mainly due to the projected faster growth of cosmetics & toiletries products among other leading countries in the region, such as China and India during the forecast period.

The per capita consumption (PCC) of cosmetics & toiletries in the Philippines, which stood at 8.4 units in 2018, was lower than both the APAC and global levels. It is expected to increase to 8.8 units by 2023.

| Brand | USP | Category they target | Price point | Vegan & Organic |

| Be Organic Bath & Body | Be Organic | Skincare, Hair | Above 300 P | Yes |

| Beauty Bakery | Skincare | Under 1k P | Yes | |

| Ellana Mineral | Best mineral makeup for all skin types | Skincare, Makeup | Above 1k P | Yes |

| Happy Skin Cosmetics | Free shipping nationwide for orders P2500 above | Skincare, Makeup | Above 1k P | No |

| Human Nature | Beauty with compassion | Skincare | Under $50 | Yes |

| Made By David Organics | Skincare, Hair | Under 600 P | Yes | |

| V&M Natural | We care about the environment. Return your empty bottles and we’ll turn them into eco bricks | Skincare | Over 1k P | Yes |

| Snoe Beauty | Free shipping for min purchase of 2k P | Makeup | Over 1k P | No |

| SUESH | Makeup | Over 500k P | No | |

| Zenutrients | Don’t panic. Use organic | Skincare, Hair | Over 1k P | Yes |

Brands from Thailand

Thailand’s beauty and personal care products market was valued at approximately $6.2 billion in 2018 and is expected to reach $8.0 billion in 2022. Thailand’s beauty industry has grown by 7.2-7.9% annually over the last six years. The beauty care and personal care market in Thailand is projected to have a healthy growth of 7.3% per year from 2019 to 2022. Beauty and personal care segments are among the fastest growing of consumer goods areas.

| Brand | USP | Category they target | Price point | Vegan & Organic |

| Srichand | Buy B288, get a free shopping bag | Makeup | Under 1k Baht | No |

| Mistine | Makeup, Skincare | Under $50 | No | |

| Thann | Sample with every purchase | Skincare | Above $100 | Yes |

| Siam Botanicals | Natural & Organic skincare | Skincare | Above 700 Baht | Yes |

| Oriental Princess | Get a lifetime membership when you purchase over 300 products | Makeup, Skincare, Hair | Above 1k Baht | No |

| Phutawan | Sign up and get 5% off | Skincare | Under 300 Baht | Yes |

| Stylevana | Get 10% off on your first order | Makeup, Skincare | Above 1k Baht | No |

| NAMULIFE | Beauty is healthy | Skincare | Above 900 Baht | Yes |

| Divana | Skincare | Under $200 | Yes |

Brands by use case

Products by Skincare

| Brand | Product | USP/Mission | Price point | Organic | Vegan | Cruelty free |

| Frank Skincare | Juicier Face Oil | Truly Organic, Always | $68 SGD | Yes | ||

| Thann | Essential Oil | Sample with every purchase | $43 USD | Yes | Yes | |

| Siam Botanicals | Face Cleanser | Natural & Organic skincare | 745 Baht | Yes | Yes | |

| Sigi Skin | Serum | Free international delivery over $200 | $118 SGD | Yes | ||

| Pera Skincare | Facial Toner | Enjoy up to 50% discount + free shipping to SG & HK | $29 SGD | |||

| Be Organic Bath & Body | Cocoa & Shea Healing Salve | Be organic | 225 P | Yes | ||

| V&M Naturals | Serum Foundation | We care about the environment. Return your empty bottles and we’ll turn them into eco bricks | 850P | Yes | ||

| Zenutrients | All is Well Oil | Don’t panic. Use organic | 140P | Yes | Yes | Yes |

| Human Nature | Nourishing Facial Wash | Bursting with goodness! | 80P | Yes |

Products by Hair care

| Brand | Product | USP/Mission | Price point | Organic | Vegan | Cruelty free |

| Be Organic Bath & Body | Sulfate free aloe shampoo | Cleanse, softens, protects | 179.10 P | Yes | ||

| Human Nature | Natural Shampoo Bar | Unleash the bubbles! Ditch the plastic bottles | 250P | Yes | ||

| Made by David Organics | Dry Shampoo | 250 P | Yes | |||

| Zenutrients | Shampoo | Don’t panic. Use organic | 249P | Yes | Yes | |

| Oriental Princess | Hair serum | Get a lifetime membership when you purchase over 300 products | 395 Baht | |||

| Miss Natural Store | conditioner | 95 RM | Yes | Yes | Yes | |

| Be Organic Bath & Body | All natural aloe conditioner | 179.10 P | Yes | |||

| Human Nature | Strengthening + Plus shampoo | Unleash the bubbles! Ditch the plastic bottles | 160 P | Yes | ||

| Oriental princess | Heat protection spray | Get a lifetime membership when you purchase over 300 products | 215 Baht |

Products by Makeup

| Brand | Product | USP/Mission | Price point | Organic | Vegan | Cruelty free |

| Velvet Vanity | Baewatch Lipstick | $12 | Yes | Yes | ||

| DIDA | Eyeshadow | RM108.50 | Yes | |||

| Rollover Reaction | Eyebrow Tint | Free shipping on orders over IDR 1k | IDR 109k | |||

| ESQA | Lip gloss | ESQA loyalty points | IDR100k | Yes | ||

| Liht Organic | Foundation | Organic makeup that’s safe enough to eat | $58 | Yes | Yes | |

| Sen Natural | Lipstick | Fast worldwide delivery | $25 | Yes | ||

| Ellana Cosmetics | Matte Powder | Best mineral makeup for all skin types | 499P | Yes | Yes | |

| Human Nature | Lip Butter | Lock in intensive lip hydration | 130P | Yes | ||

| Be Organic Bath and Body | Liquid lipstick | Matte but not flat | 360P | Yes |

Digital World

Sellers

| Single brand retailers prominent in online | BodyBoss, Skinny Mint, Coco & Eve, Sand and Sky |

| Multi brands online retailers | Sephora, Hermo, Althea, |

| Multi brand offline retailers | Sephora, Robinson |

| Beauty Subscription companies | Companies which allows product to be bought on subscription like https://bellabox.com.au/ |

How to plan Digital Strategy for Beauty brands

You can consider the below elements of a persona to derive your digital strategy and digital marketing for beauty brands.

- Age: Skin care products especially focus heavily on age ranges. An anti-wrinkle cream will probably be for women over 35. What problem does your product solve?

- Location: Considering the private label model, target the location you can ship to.

- Gender: Skin care products are very specifically manufactured for different genders.

- Interests: On Facebook, you can identify groups with specific interests. Health? Beauty? Fashion? A like on a page just got you a lead.

- Education level: This will tell you what the tone of your messaging should be.

- Income level: An important one based on the price of your product.

- Relationship status: Relationships change buyer behavior.

- Language: You’ll base this on the location you’re targeting.

- Favorite websites: How do they spend their time online? The content will steer your tone in advertising.

- Buying behavior: How do they buy? Is there a lot of research involved, or are pretty pictures enough? What content drives them to act? This will be a great indicator to see if coupons and samples work for your market.

- Buyer pain points: What is their pain point and how can you solve it?

- Buyer concerns: What questions might they have about your product? How can you incorporate that information in your advertising?

Notable behaviors

How influencer culture has affected the industry and consumer tastes?

- Social media has changed the game in the beauty industry all over the world including Southeast Asia as it is critical for business successes. It has a huge influence on how consumers are shopping. Southeast Asia has one of the highest social media usage in the world. Facebook, Instagram, and Youtube are the most popular social media networks.

- 71% of US consumers are the heaviest social media users as well as beauty product buyers. Social media poses and encourages them to buy certain products that they see online.

- 40% of UK consumers have viewed beauty content on social media and liked or followed a beauty brand.

- 32% of Chinese women who have worn makeup say the appealing looks of bloggers on social media influences them to buy makeup.

- 96% of marketers agree that social commerce will become increasingly important in the next five years while 90% agree that social media drives online sales. 6 in 10 consumers have said more than ¼ of their online shopping is influenced by social media; Facebook (78%) and Youtube (52%).

- Consumers are bonding and building relationships with influencers

- Consumers look for influencers who speak to them or look like them or have the same struggles they do

- Millennials are a focus for most brands and marketers. They tend to be more engaged and more likely to try new things.

- 63% of Brazilian millennials used their smartphones to research a product

- 31% of younger millennials in the US feel social media is a good platform for brands to reach them

- 41% of UK younger millennials report posting a selfie compared to only 24% of older millennials

What channels influencers use?

- Tik Tok

- Youtube

- Blogs

Marketing Approaches

- Consumers listen to influencers, not company ads

- People trust third-party product reviews most and company advertisements least.

- Influencer marketing sways purchasing decisions most, while direct-mail marketing is the least effective way to reach people

- Instagram is used most, followed by Facebook then Youtube

- It’s very visual, and it’s simple to put a lot of photos and short videos out there to immediately reach your followers. You can directly respond to people’s comments, so there’s easy communication back and forth

- YouTube is also preferred for longer how-to videos and watch how influencers apply products and find inspiration

- Figure out which social media channels will attract your audience, be deliberate about how you showcase your products on different channels, and make sure the people who represent your company will be seen as authentic, trusted voices of the image you want to present.

- Consumers listen to influencers, not company ads

- Beauty technology

- From artificial intelligence to 3D-printing, augmented reality and DNA analysis, the beauty industry is becoming increasingly technology-driven

- online video consultations with a dermatologist, aesthetic doctor or cosmetic surgeon

- The use of augmented reality in beauty allows for increased personalization and customization during the shopping process.

- Artificial intelligence-powered mobile acne testing application

- Identify a user’s type of acne lesions by analysing selfies

- Smart skincare tools/smart mirror

Offline Beauty Events

| EVENT | Country | No. of Exhibitors | No of Registrants |

| International Beauty Expo | Malaysia | 400 | 44,000 |

| Beauty Expo | Malaysia | 230 | 18,000 |

| Cosmobeaute | Malaysia | 253 | 12,316 |

| Cosmobeaute | Indonesia | 270 | 11,812 |

| Beauty Asia | Singapore | 250 | 10,000 |

Beauty Trends: Where the industry is going?

Using minimal and natural-ingredient products

- Every year, the cosmetic industry creates non-recyclable plastic to hold their products that are harmful and negatively impacts the environment. Makeup artists and influencers are starting to cut back on their consumption and are encouraging others to do the same as environmental awareness is becoming mainstream in the millennial and Generation Z markets.

- The demand for natural-ingredient products is on the rise that skincare and beauty products no longer need to rely on synthetic ingredients. Consumers want to know where their ingredients or materials are sourced, how they’re made, who they’re made by, and whether they will support or damage their health in the long run. Because products are placed directly on the skin, the interest in holistic health has triggered this new demand.

- A common theme of indie beauty brands is going for the minimalist approach. Example: S.W Basics believes less is more. “It’s about simplicity. Our whole thing is that fewer ingredients means gentler skincare. And the simpler your routine, the better. Our products are effective, easy to use, and made for everyone.

Male & Gender Neutral Products

- Most cosmetic products have always been suitable for both men and women however the usage of these products are still viewed as predominantly feminine, besides South Korea as male makeup is fairly accepted.

- In recent years, there have been a growing number of male consumers and gender neutrality could be a big opportunity for the beauty sector. Gender-neutral brands like The Ordinary and Non Gender Specific have registered significant growth in male-identifying customers. As Gen Z enters the marketplace, and male customers become increasingly comfortable with skincare, brands will prefer an ingredients-first approach to gendered marketing.

- Example of brands that offer male/gender neutral products: Panacea, Aesop, Asarai, Curology

- Example of male skin care routine (night)

- Wash face

- Cleanser

- Toner

- Essence

- Serum

- Moisturize

Integration with fitness and wellness

- Fitness and wellness industries have boomed in recent years. The beauty industry is taking note and is becoming more closely tied to the fitness and wellness industries to support a health-conscious lifestyle that today’s consumers aspire to

Conclusion

With the digital world, things have become easier for beauty brands to market and sell products all around the globe. Because of technology, such as social media, blog posts, live streams, they will continue to drive the rise of brands especially young ones from here on out. Social media is critical for a lot of businesses today as it serves as not only a sales channel but a strong marketing communication channel for consumers.

It’s important for brands to understand the kind of target audience that they are looking at because their content has to be relevant to these kinds of audience. While technology has been convenient for consumers, their attention span is very short as well as them being very selective of the kind of content they’re looking at, thus it is important for brands to identify the demographics they’re after in order to have an effective marketing campaign.

If you are looking for more strategic help on growing your business in the beauty industry, reach out to us at [email protected]. We help you with intelligence of market landscape, strategic consulting and execution of your digital campaigns + building online platforms.